“Digital banking,” “super apps,” “hyper-personalization,” “customer experience,” and “agility” — are the terms redefining the BFSI industry today.

There has been a steady rise in banks and financial services organizations adopting powerful new-age digital solutions to reach and connect with customers on various digital touchpoints, driving the evident and much-needed shift from “financial inclusion” to “financial empowerment.”

In a highly digitized landscape, banks and other financial services firms must identify and respond immediately to customer demands, presenting them with personalized offerings and solutions for their needs. In other words, companies must reach out and interact with customers at key moments in their life, generating excitement, and moving from a reactive approach of selling products to proactively anticipating and exceeding customer needs.

The advent of conversational AI and NLP in the form of chat and voice bots has empowered banks to mimic the branch experience at scale with the ability to converse in the customer’s preferred language.

Moreover, technologies, such as AI and machine learning, cloud computing, and DevOps have come to the forefront in automating fraud detection and anti-money laundering and delivering more optimized and hyper-personalized experiences to customers.

Additionally, even though banks invest large sums of money in contact centers for handling inbound customer queries, a majority of these calls are generic and repetitive. Modernizing contact centers with AI-enabled IVR technology takes the pressure off human agents and allows them to focus on critical tasks, thereby optimizing operating costs.

Let’s explore in detail how digital transformation is revolutionizing the banking and financial services industry (BFSI).

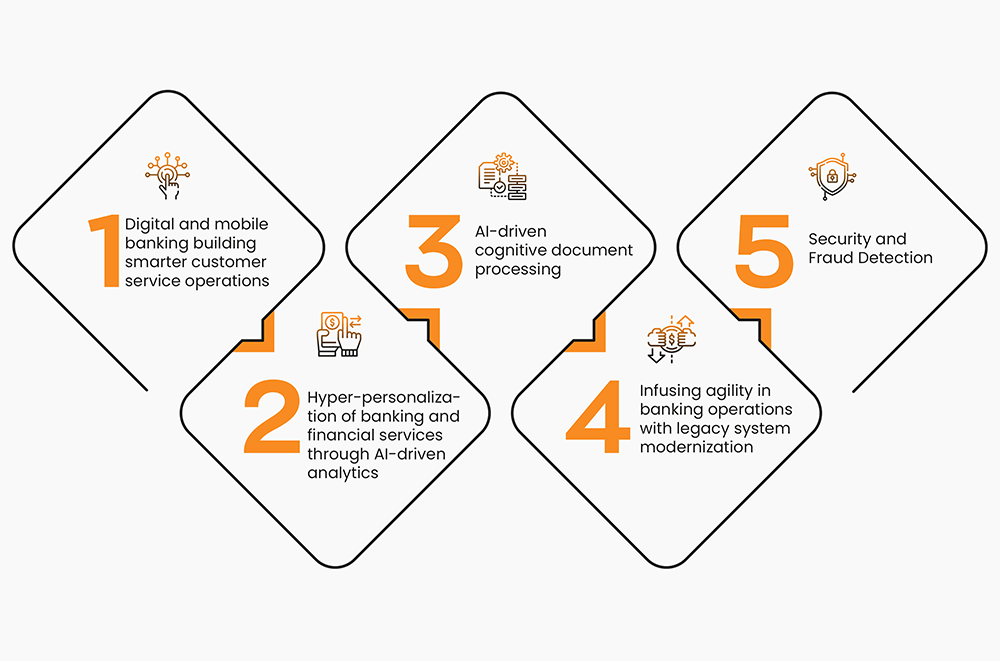

5 Digital Transformation Use Cases for the BFSI Industry

The pandemic has fast-tracked digital behaviors, redefining how customers want to engage with their banks. Indeed, we’re entering a world of ever-increasing digital banking adoption, and the acceleration of contactless and mobile payments.

Even though growing revenue will always remain a priority for the BFSI sector, the attention is now shifting towards innovating and enhancing products and services to provide an exceptional customer experience.

1. Digital Transformation in Banking: Building Smarter Customer Service Operations

The Digital Banking Platform Market is expecting growth at a CAGR of 11.2% from 2021 to 2026, driven significantly by the rapid evolution of digital strategies in the industry and the increasing customer preference for digital banking services.

The shift to digital and mobile banking has primarily been driven by people working from home and wanting to transact on their bank’s portal through their phone or laptop.

AI-based chat and voice bots are helping banks provide customer services on several digital touchpoints, particularly mobile banking, without necessitating a visit to the branch or speaking to contact center agents. The rise in mobile banking can be attributed to the emerging popularity of virtual assistants and also super apps, a one-stop tech app for all banking and financial needs, that help in better and easier financial planning and management.

Bots can service hundreds of customer requests simultaneously and allow human agents to focus on critical tasks and higher priority customers.

Bots can handle transfers, payments, credit card activation, password resets, blocking stolen or lost cards, updating beneficiaries, and reminders for payment of EMIs for customers anytime and from anywhere. This frees up customer-service teams to focus on more complex customer inquiries and enhance productivity.

U.S Bank launched an AI-enabled Smart Voice Assistant embedded in its Android and iOS app to allow users to carry out banking requests using conversational language.

Acting as a digital bank teller, the AI voice bot starts listening when a customer taps on the microphone button in the app. It then enables customers to pull up bills and spending history, carry out transfers, and manage credit cards.

Most recently, the bank has debuted a Spanish-speaking version of this voice assistant. Users can use this feature simply by changing the U.S. Bank mobile app language preference to Spanish.

Bots help build smarter contact centers through the following functionalities:

- Conversational IVR – Conversational AI platforms that use NLP technologies can be integrated with the IVR systems. These conversational IVR systems can handle a surge in calls by answering repetitive questions and preventing panic among customers.

- Assisting customer service agents – To help customers quickly and resolve their queries smoothly, contact center agents can use chat or voice bots to draw up the relevant knowledge and background information from CRMs and leverage it to find relevant solutions for customers.

- Transferring calls to the relevant agents – For complex queries that demand human attention, or in cases when the customer is angry, bots can route the query and escalate the case to the right agents.

2. Digital Transformation in Financial Services and Banking: Achieving Hyper-Personalization with AI-Driven Analytics

Powerful technologies like AI and machine learning are helping BFSI firms develop innovative business models that hyper-personalize customer journeys and promote financial inclusion.

Banks can now deploy bots that are powered with technologies such as sentiment analysis and support over multiple languages and dialects, offering customers convenient and personalized, branch-like services.

Moreover, advanced AI-driven smart analytics and Big Data analytics can analyze customer needs, behavior, and profiles and suggest suitable financial products and services. Sophisticated machine learning and natural language capabilities allow accurate discovery of the customer’s intent, facilitate engagement beyond elementary interactions, and allow contextual engagement that improves customer experience and CSAT scores.

For example, AI-enabled voice assistants can determine the customer’s eligibility for loans, enable disbursal, and also keep track of EMIs.

Chat and voice-enabled bots can also offer intelligent savings and investment advice armored with customer data.

3. AI-driven cognitive document processing

BFSIs worldwide process millions of simple and complicated documents everyday, including KYC documents, identify proofs, contracts, legal and trust documents, financial reports, and forms.

Cognitive Document Processing is an end-to-end solution powered by advanced machine learning and artificial intelligence technologies that automates the quick, secure, and cost-effective organization, ingestion, and evaluation of documents

Take for example, Microsoft’s Azure Forms Recognizer. Azure Forms Recognizer can comprehend structured and unstructured documents, including machine print and cursive handwriting. All you have to do is tailor the tool to understand your documents and extract tables, structures, and key-value pairs, both on-premises and in the cloud.

How does the technology work? As a first step, documents are scanned and classified. Data extraction and validation follow next. Lastly, information is then moved via APIs or RPA into downstream processes like underwriting/credit, loan origination, etc.

4. Infusing agility in banking operations with legacy system modernization

Traditional banking and financial services institutions face significant threat from the new players, particularly the fintechs and neobanks, that have reconfigured the BFSI industry with personalized digital banking services at lower costs.

To drive innovation, ensure survival and profitability, and withstand competition, traditional banks must modernize operations by —

- adopting highly agile and future-proof technologies like low-code app development platforms

- undergoing legacy system modernization by migrating to cloud computing

- implementing AIOps to optimize cloud consumption and reduce costs

5. Security and Fraud Detection

In today’s increasingly digitized business landscape, AI and machine learning play a significant role in augmenting operations and cybersecurity. With cyber hackers stealing bank accounts, credit card, and financial security details and siphoning money off customers, it has become imperative for organizations to prevent all possible fraudulent activity.

Banks and other financial institutions implement AI/ML-driven models to detect anomalous activity. The model, trained on a continuous stream of incoming data, knows what the normalized levels of activity are with regard to banking and other financial transactions. Consequently, it can alert the human agent in case of any deviations from the expected trends.

Another method used by banks and other financial institutions is “behavior profiling.” Behavior profiling studies customers, accounts, merchants, and other entities to build a profile and understand how, where, or what type of transactions are done. This information proves of immense value in detecting anomalous activity.

As important as it is to diagnose suspected fraudulent activity in real-time, what’s even more essential is to score a transaction on its quantum of risk. That’s precisely what predictive analytics does. Additionally, prescriptive analytics leverages the data collected by predictive analytics to suggest what should be done if fraud is detected.

How can Acuvate help?

Acuvate is a leading global player in next-generation digital services and consulting. As a Microsoft Gold Partner with 15+ years of experience in the industry, we leverage all things Microsoft to build enterprise applications that help in intelligent analysis, collaboration, and orchestration of information.

We leverage our enterprise bot-building platform called BotCore and Microsoft’s low-code bot building application Power Virtual Agents to build bots that streamline operations in the banking and financial services sector.

Our advanced analytics solutions are backed by the best AI and ML technologies and help the BFSI industry hyper-personalize customer journeys and increase customer satisfaction while preventing fraudulent activity.

Additionally, our AI-driven managed services help companies in the BFSI sector efficiently undertake application modernization, business process automation, cloud migration, enhance agility, and reduce costs.

To know more about our services for the BFSI sector, please feel free to schedule a personalized consultation with our experts.